ACCOUNTANCY THEORY NOTES

🔰STOCK & DEBTORS SYSTEM ( ANALYTICAL SYSTEM )

🔰🔰PREVIOUS YEARS QUESTION PAPER BASED THEORY QUESTIONS AND ANSWERS🔰🔰👇👇

⭕🔰ADVANTAGES & DISADVANTAGES OF AVCOUNTING⭕🔰

Accounting is the process of recording, analyzing, and reporting a business's financial transactions. It also refers to the principles and procedures of this system

🔰Advantages of Accounting

Maintenance of business records

Preparation of financial statements

Comparison of results

Decision making

Evidence in legal matters

Provides information to related parties

Helps in taxation matters

Valuation of business

Replacement of memory

⭕Maintenance of business records

It records all the financial transaction pertaining to the respective year systematically in the books of accounts. It is not possible for management to remember each and every transaction for a long time due to their size and complexities.

⭕Preparation of financial statements

Financial statements like Trading and pro

profit and loss account, Balance Sheet can be prepared easily if there is a proper recording of transactions. Proper recording of all the financial transactions is very important for the preparation of financial statements of the entity.

⭕Comparison of results

It facilitates the comparison of the financial results of one year with another year easily. Also, the management can analyze the systematic recording of all the financial transactions according to the policies of the entity.

⭕Decision making

Decision making becomes easier for management if there is a proper recording of financial transactions. Accounting information enables management to plan its future activities, make budgets and coordination of various activities in various departments.

⭕Evidence in legal matters

The proper and systematic records of the financial transactions act as evidence in the court of law.

⭕Provides information to related parties

It makes the financial information of the organization available to stakeholders like owners, creditors, employees, customers, government etc. easily.

⭕Helps in taxation matters

Various tax authorities like income tax, indirect taxes depends on the accounts maintained by the management for settlement of taxation matters.

⭕Valuation of business

For proper valuation of an entity’s business accounting information can be utilized. Thus, it helps in measuring the value of the entity by using the accounting information in the case of sale of the entity.

⭕Replacement of memory

Proper recording of accounting transactions replaces the need to remember transactions.

🔰Disadvantages of Accounting

Expresses Accounting information in terms of money

Accounting information is based on estimates

Accounting information may be biased

Recording of Fixed assets at the original cost

Manipulation of Accounts

Money as a measurement unit changes in value

⭕Expresses Accounting information in terms of money

Non-financial transactions cannot be given effect to in books of accounts. Only transactions of financial nature are measurable by the accountant. In fact, financial transactions are expressed in terms of money.

⭕Accounting information is based on estimates

There are some accounting data which are based on estimates. Thus, inaccuracy in estimates is possible.

Accounting information may be biased

Accountants personal influence affects the accounting information of the entity. Different methods of inventory valuation, depreciation methods, treatment of revenue and capital expenses etc can be adopted by the accountant for measurement of income of the entity.

⭕Recording of Fixed assets at the original cost

There can be a difference between the original cost and current replacement cost of a fixed asset due to efflux of time, change in technology etc. Thus, the balance sheet may not show the true financial status of an entity.

⭕Manipulation of Accounts

The accountant or management can manipulate or misrepresent the profits of an entity.

⭕Money as a measurement unit changes in value

Stability in the value of money is not possible. Accounting information will not show the true financial position if changes in the price level are not considered.

⭕⭕⭕⭕⭕⭕⭕

🔰Characteristics of Accounting:🔰

The following attributes or characteristics can be drawn from the definition of Accounting:

(1) Identifying financial transactions and events

Accounting records only those transactions and events which are of financial nature.

So, first of all, such transactions and events are identified.

(2) Measuring the transactions

Accounting measures the transactions and events in terms of money which are considered as a common unit.

(3) Recording of transactions

Accounting involves recording the financial transactions inappropriate book of accounts such as Journal or Subsidiary Books.

(4) Classifying the transactions

Transactions recorded in the books of original entry – Journal or Subsidiary books are classified and grouped according to nature and posted in separate accounts known as ‘Ledger Accounts’.

(5) Summarising the transactions

It involves presenting the classified data in a manner and in the form of statements, which are understandable by the users.

It includes Trial balance, Trading Account, Profit and Loss Account and Balance Sheet.

(6) Analysing and interpreting financial data

Results of the business are analyzed and interpreted so that users of financial statements can make a meaningful and sound judgment.

(7) Communicating the financial data or reports to the users

Communicating the financial data to the users on time is the final step of Accounting so that they can make appropriate decisions.

⭕⭕⭕⭕⭕⭕⭕⭕⭕⭕⭕⭕⭕⭕⭕

🔰DIFFERENCE BETWEEN HIRE PURCHASE AND INSTALMENT SYSTEM 🔰

🔰Difference between gross profit and net profit

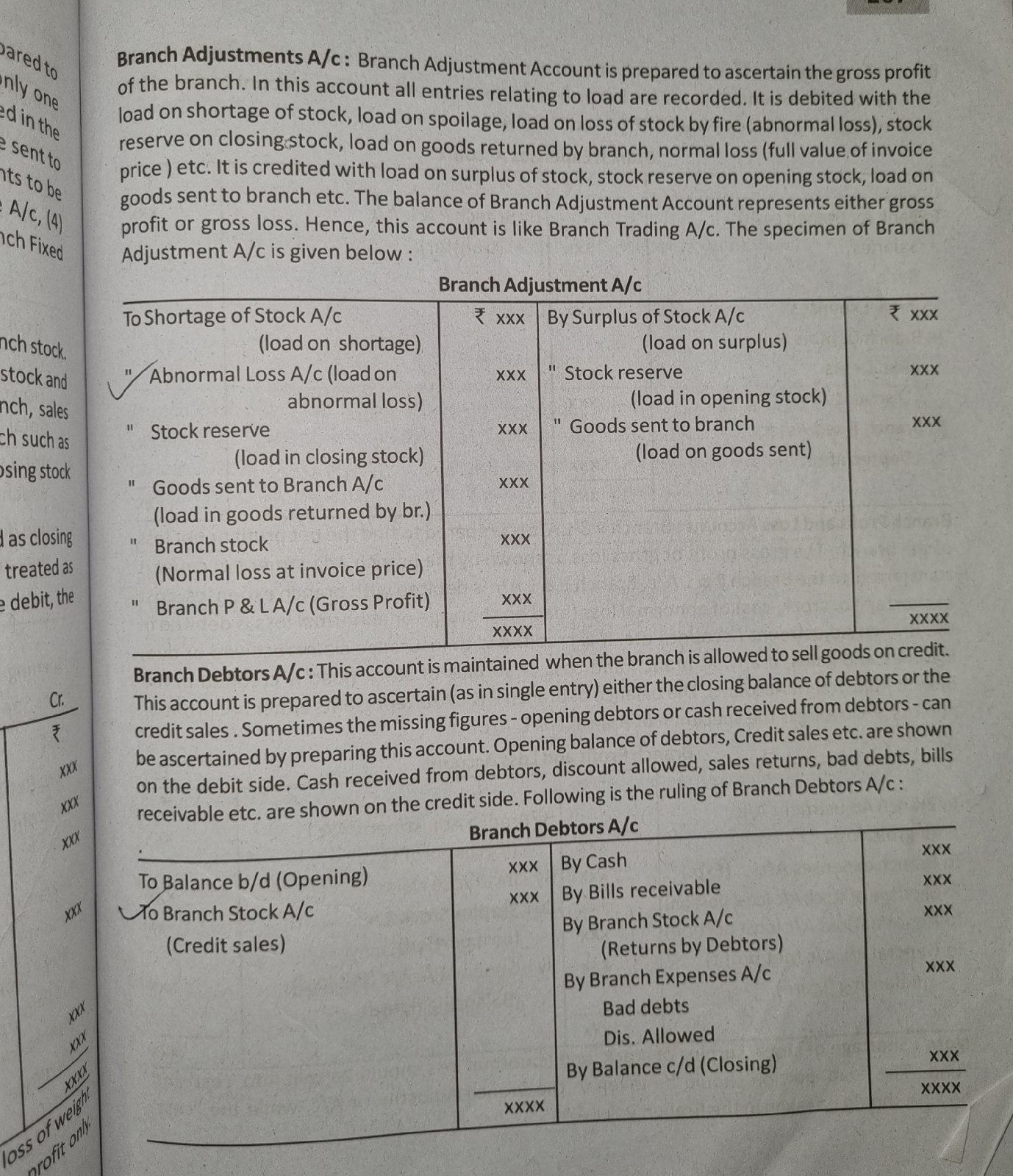

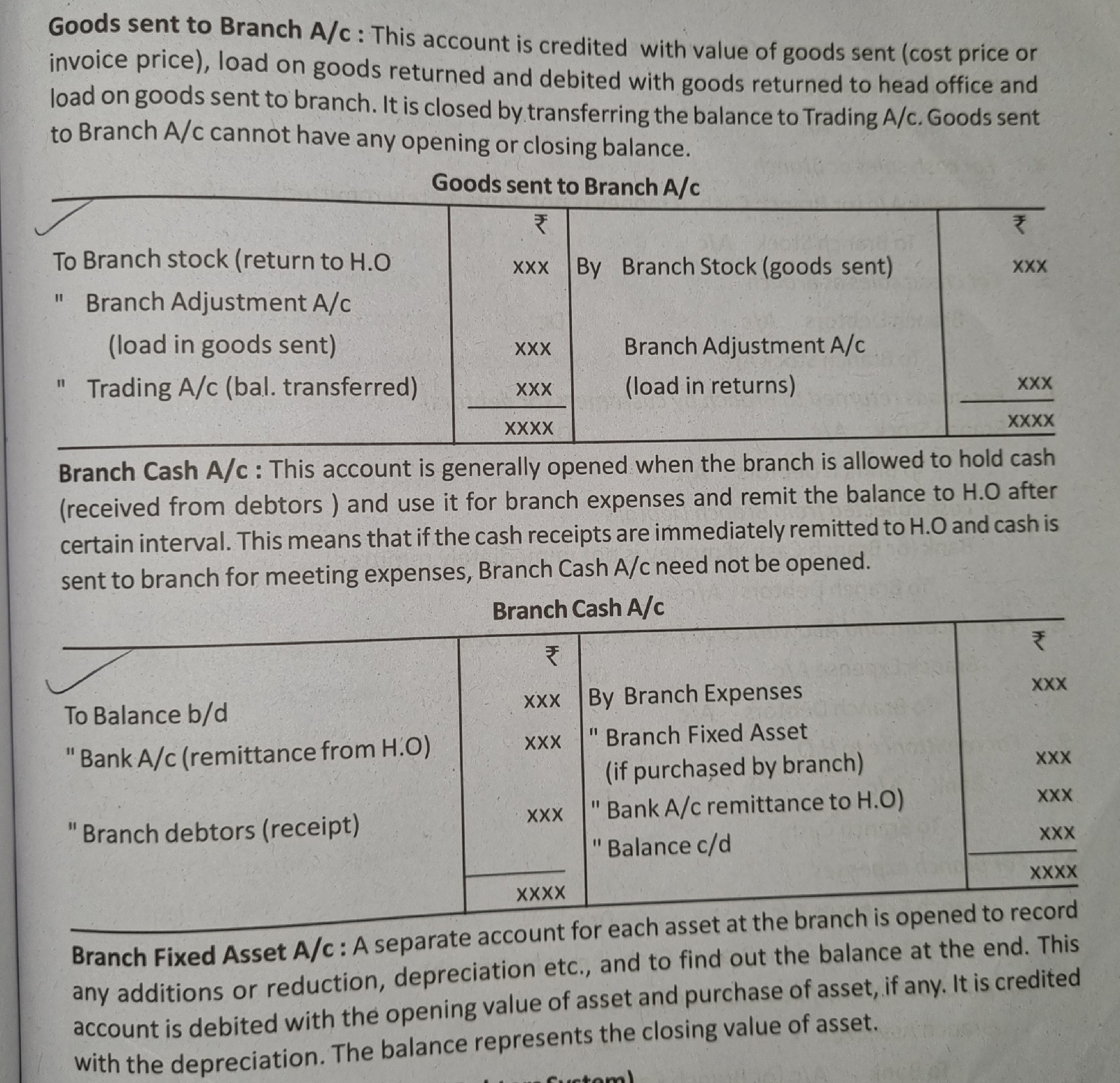

🔰BRANCH TRADING AND PROFIT AND LOSS ACCOUNT

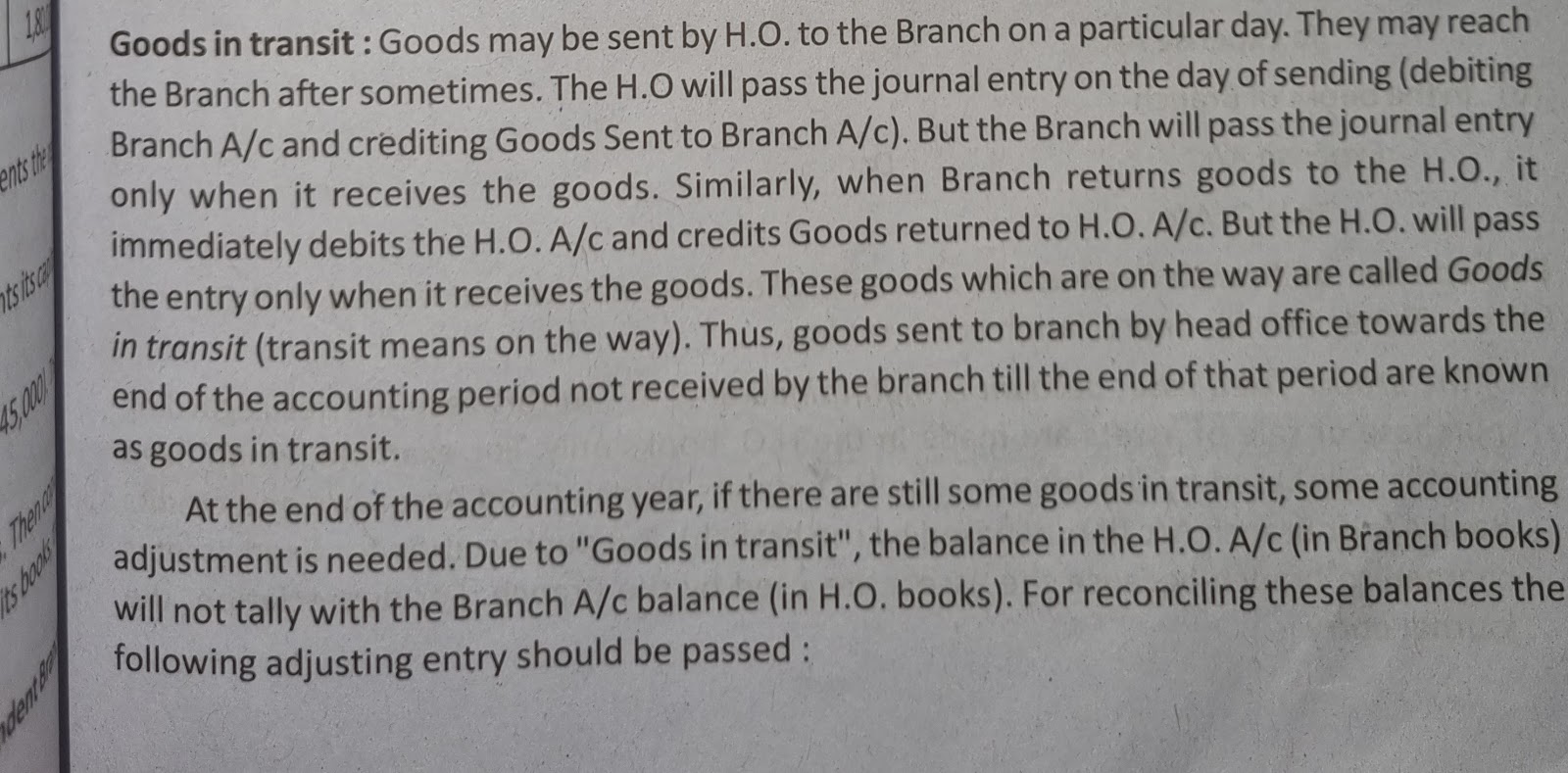

🔰GOODS IN TRANSIT, CASH IN TRANSIT, INTERBRANCH TRANSFER🔰

🔰 TRAIL BALANCE 🔰

🔰SHORTWORKINGS🔰

🔰MINIMUM RENT

🔰CONSIGNMENT VS SALES

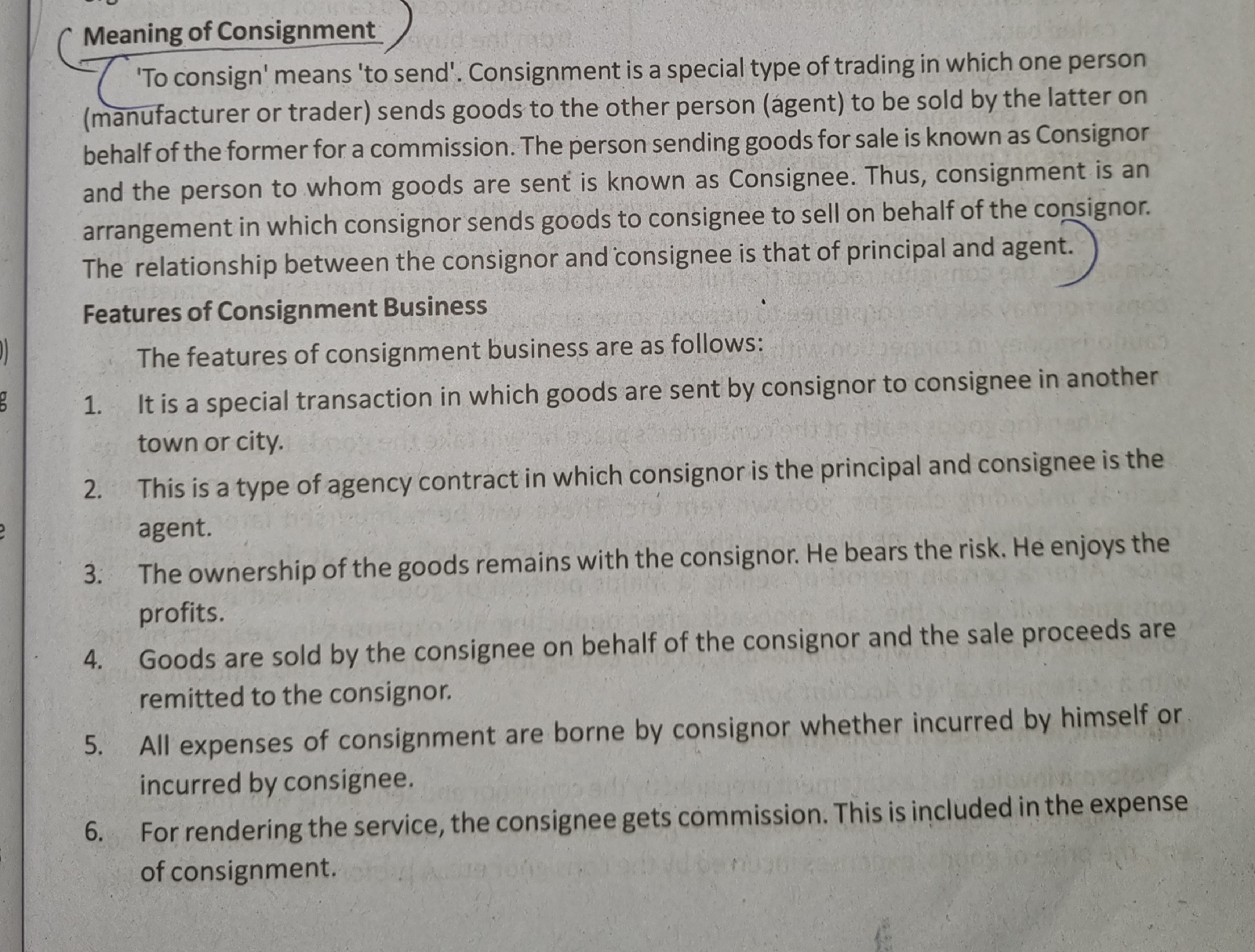

🔰CONSIGNMENT MEANING

🔰PROFORMA INVOICE

🔰ACCOUNT SALES

🔰INVOICE VS ACCOUNT SALES

🔰COMMISSION

🔰 COMPLETE REPOSSESION

🔰PARTIAL REPOSSESION

Comments

Post a Comment